The State of Ransomware in Financial Services 2024

Credit to Author: Doug Aamoth| Date: Mon, 24 Jun 2024 15:02:35 +0000

IT and cybersecurity leaders reveal ransomware realities for financial services businesses today.

Read MoreRSS Reader for Computer Security Articles

Credit to Author: Doug Aamoth| Date: Mon, 24 Jun 2024 15:02:35 +0000

IT and cybersecurity leaders reveal ransomware realities for financial services businesses today.

Read MoreCredit to Author: Tim Ayling| Date: Thu, 06 Sep 2018 16:25:04 +0000

Facebook wants to be your financial service and wants your banking data. But do you want Facebook to have it?

Read MoreCredit to Author: Kim Tremblay| Date: Mon, 05 Feb 2018 13:34:22 +0000

Wall Street is all abuzz about blockchain- especially for banking and financial services. Some consider it a threat while others see it as an opportunity to digitize the industry. Still,… Read more »

The post Blockchain: 3 Reasons It’s Good for Financial Services appeared first on Schneider Electric Blog.

Read More

Credit to Author: Ken Mingis| Date: Wed, 13 Dec 2017 10:30:00 -0800

It’s the most disruptive technology since the arrival of the Internet.

Or maybe it’s the next Linux, an open-source technology that offers great promise, but somehow never seems to make it to the mainstream world.

“It,” in this case, is blockchain – the buzz-worthy distributed ledger technology that first came into widespread use with Bitcoin represents a new paradigm for the way information is shared. FinTech firms are embracing it and a variety of companies are already rushing to figure out how they can use it to save time and admin costs, according to Computerworld Senior Reporter Lucas Mearian.

Credit to Author: Lucas Mearian| Date: Thu, 07 Dec 2017 03:20:00 -0800

Over the next two years, enterprises are expected to ramp up their efforts to test blockchain technology as part of a new method of establishing trust in a digital economy.

New research from consultancy Deloitte LLP shows a “trust economy” is now developing around person-to-person (P2P) transactions enabled by blockchain technology and not dependent on more traditional methods such as credit ratings or guaranteed cashier’s checks.

“Rather, it relies on each transacting party’s reputation and digital identity – the elements of which may soon be stored and managed in a blockchain,” Deloitte analysts said in a report.

Credit to Author: Matthew Finnegan| Date: Mon, 20 Nov 2017 11:03:00 -0800

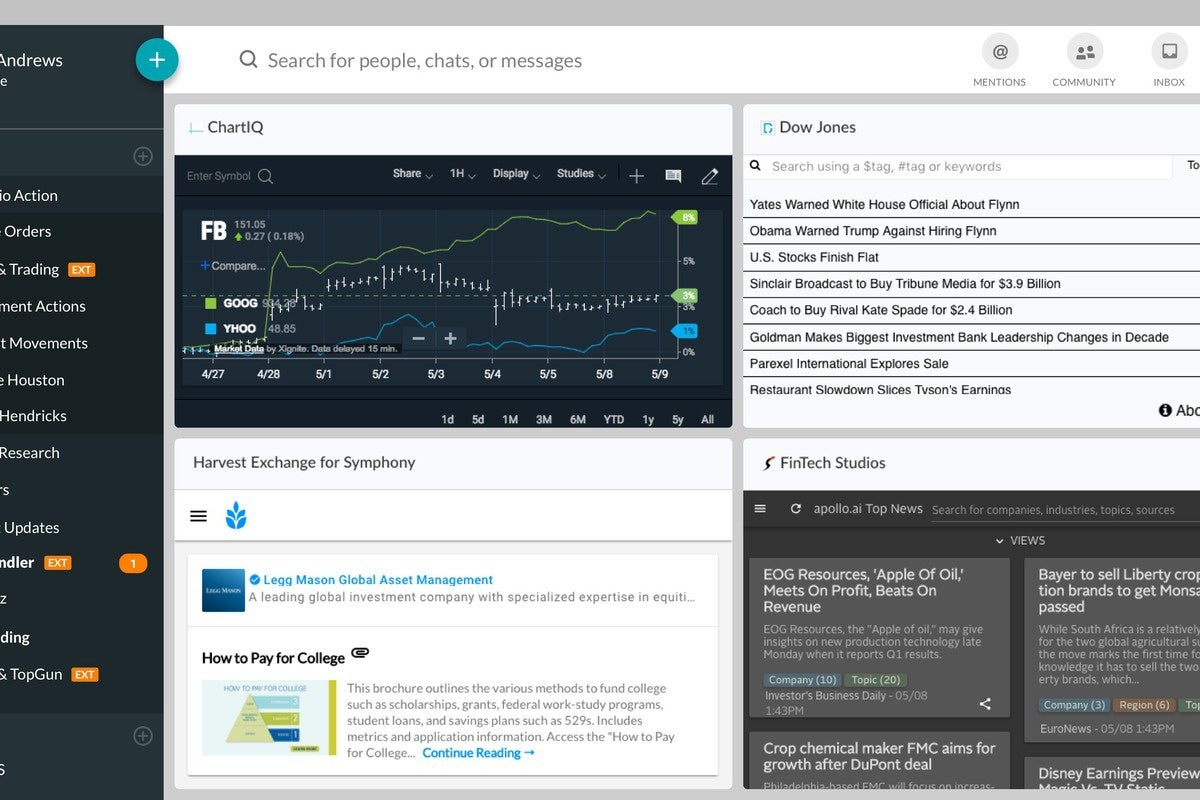

Symphony has been called a ‘Bloomberg-killer’ since its launch in 2014 because it offers a cheaper alternative to the chat function in the popular data terminals long considered a mainstay for traders.

The secure messaging and collaboration platform started out as an in-house chat tool at Goldman Sachs, providing secure communications between employees and allowing them to easily share sensitive documents. Symphony is now valued at over $1 billion, according to reports, and has 235,000 subscribers, with users that range from traders and portfolio managers to salespeople and risk managers.

Credit to Author: Lucas Mearian| Date: Fri, 10 Nov 2017 03:11:00 -0800

While blockchain appears ready to upend business processes and trust models across a myriad of industries, it’s still in its early days and the various iterations of the distributed ledger already in use are far from vetted.

To read this article in full, please click here

(Insider Story)

Read More

Credit to Author: Lucas Mearian| Date: Tue, 07 Nov 2017 17:06:00 -0800

Blockchain is poised to change IT in much the same way open-source software did a quarter of a century ago. And in the same way that Linux took more than a decade to become a cornerstone in modern application development, Blockchain will take years to become a lower cost, more efficient way to share information between open and private networks.

But the hype around this seemingly new, secure electronic ledger is real. In essence, blockchain represents a new paradigm for the way information is shared and tech vendors and companies are rushing to figure out how they can use the distributed ledger technology to save time and admin costs. Numerous companies this year have been rolling out pilot programs and real-world projects across a variety of industries – everything from financial services to healthcare to mobile payments.

To read this article in full or to leave a comment, please click here