Google, Hyperledger launch online identity management tools

Credit to Author: Lucas Mearian| Date: Mon, 15 Apr 2019 03:00:00 -0700

In two separate announcements last week, Google and Linux’s Hyperledger project launched tools aimed at enabling secure identity management for enterprises via mobile and other devices.

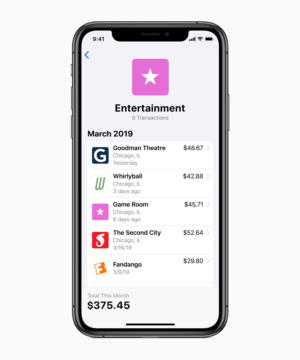

Google unveiled five upgrades to its BeyondCorp cloud enterprise security service that enables identity and access management for employees, corporate partners, and customers.