Survey: Americans Spent $1.4B on Credit Freeze Fees in Wake of Equifax Breach

Credit to Author: BrianKrebs| Date: Thu, 22 Mar 2018 14:08:46 +0000

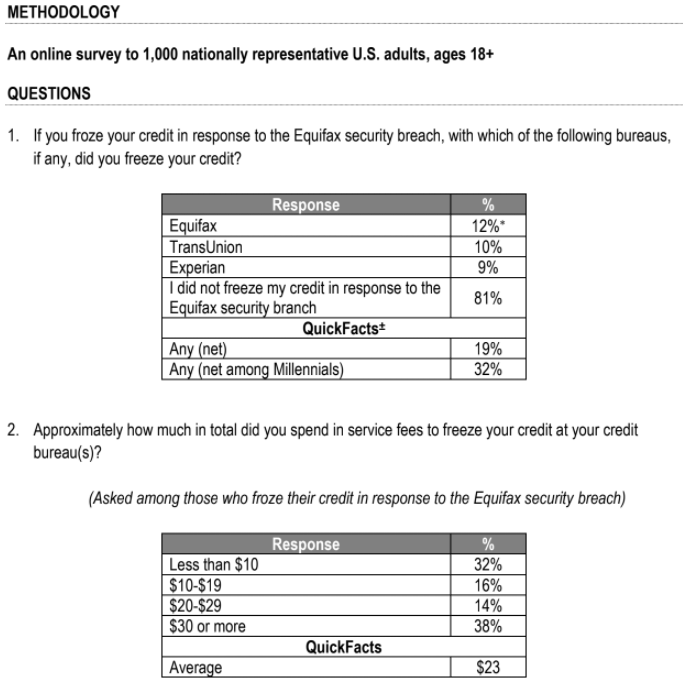

Almost 20 percent of Americans froze their credit file with one or more of the big three credit bureaus in the wake of last year’s data breach at Equifax, costing consumers an estimated $1.4 billion, according to a new study. The findings come as lawmakers in Congress are debating legislation that would make credit freezes free in every state.

The figures, commissioned by small business loan provider Fundera and conducted by Wakefield Research, surveyed some 1,000 adults in the U.S. Respondents were asked to self-report how much they spent on the freezes; 32 percent said the freezes cost them $10 or less, but 38 percent said the total cost was $30 or more. The average cost to consumers who froze their credit after the Equifax breach was $23.

A credit freeze blocks potential creditors from being able to view or “pull” your credit file, making it far more difficult for identity thieves to apply for new lines of credit in your name.

Depending on your state of residence, the cost of placing a freeze on your credit file can run between $3 and $10 per credit bureau, and in many states the bureaus also can charge fees for temporarily “thawing” and removing a freeze (according a list published by Consumers Union, residents of four states — Indiana, Maine, North Carolina, South Carolina — do not need to pay to place, thaw or lift a freeze).

Image: Wakefield Research.

In a blog post published today, Fundera said the percentage of people who froze their credit in response to the Equifax breach incrementally decreases as people get older.

“Thirty-two percent of millennials, 16 percent of Generation Xers and 12 percent of baby boomers froze their credit,” Fundera explained. “This data is surprising considering that older generations have been working on building their credit for a longer period of time, and thus they have a more established record to protect.”

However, freeze fees could soon be a thing of the past. A provision included in a bill passed by the U.S. Senate on March 14 would require credit-reporting firms to let consumers place a freeze without paying (the measure is awaiting action in the House of Representatives).

But there may be a catch: According to CNBC, the congressional effort to require free freezes is part of a larger measure, S. 2155, which rolls back some banking regulations put in place after the financial crisis that rocked the U.S. economy a decade ago.

Consumer advocacy groups like Consumers Union and the U.S. Public Interest Research Group (USPIRG) have long advocated for free credit freezes. But they’re not too wild about S. 2155, arguing that it would undermine banking regulations passed in the wake of the 2007-2008 financial crisis.

In a March 8 letter (PDF) opposing the bill, Consumers Union said the security freeze section fails to include a number of important consumer protections, such as a provision for the consumer to temporarily “lift” the freeze in order to open credit.

“Moreover, it could preclude the states from making important improvements to expand protections against identity theft,” Consumers Union wrote.

While it may seem like credit bureaus realized a huge financial windfall as a result of the Equifax breach, it’s important to keep in mind that credit bureaus also make money by selling your credit report to potential lenders — something they can’t do if there’s a freeze on your credit file.

Curious about what a freeze involves, how to file one, and other options aside from the credit freeze? Check out this in-depth Q&A that KrebsOnSecurity published not long after the Equifax breach.

Also, if you haven’t done so lately, take a moment to visit annualcreditreport.com to get a free copy of your credit file. A consumer survey published earlier this month found that roughly half of all Americans haven’t bothered to do this since the Equifax breach.