One Bitcoin Transaction Now Uses as Much Energy as Your House in a Week

Credit to Author: Christopher Malmo| Date: Wed, 01 Nov 2017 19:20:34 +0000

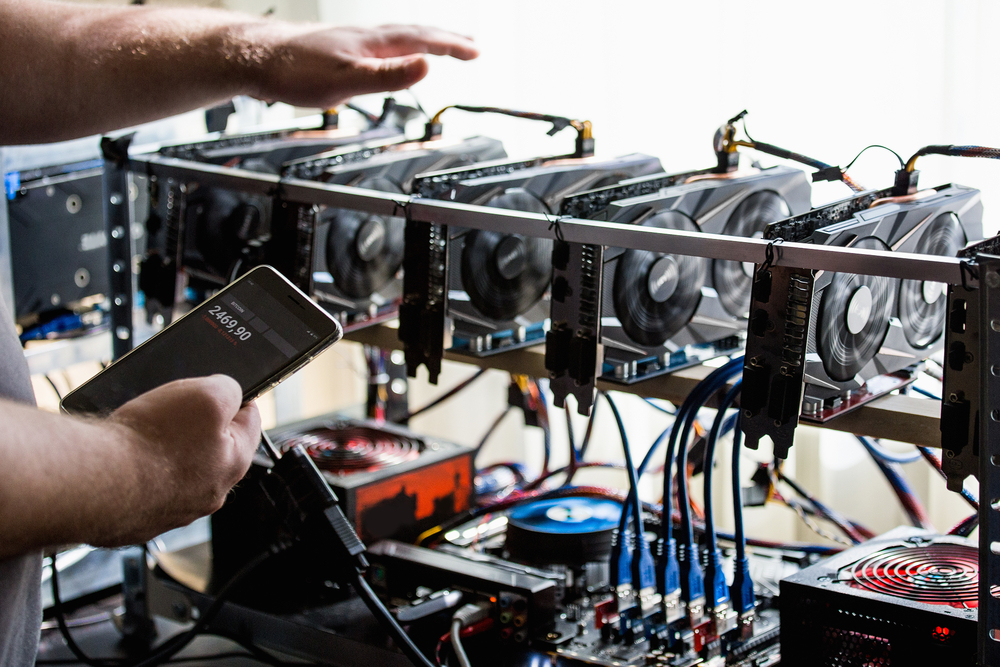

Bitcoin’s incredible price run to break over $6,000 this year has sent its overall electricity consumption soaring, as people worldwide bring more energy-hungry computers online to mine the digital currency.

An index from cryptocurrency analyst Alex de Vries, aka Digiconomist, estimates that with prices the way they are now, it would be profitable for Bitcoin miners to burn through over 24 terawatt-hours of electricity annually as they compete to solve increasingly difficult cryptographic puzzles to “mine” more Bitcoins. That’s about as much as Nigeria, a country of 186 million people, uses in a year.

This averages out to a shocking 215 kilowatt-hours (KWh) of juice used by miners for each Bitcoin transaction (there are currently about 300,000 transactions per day). Since the average American household consumes 901 KWh per month, each Bitcoin transfer represents enough energy to run a comfortable house, and everything in it, for nearly a week. On a larger scale, De Vries’ index shows that bitcoin miners worldwide could be using enough electricity to at any given time to power about 2.26 million American homes.

Expressing Bitcoin’s energy use on a per-transaction basis is a useful abstraction. Bitcoin uses x energy in total, and this energy verifies/secures roughly 300k transactions per day. So this measure shows the value we get for all that electricity, since the verified transaction (and our confidence in it) is ultimately the end product.

It’s worth asking ourselves hard questions about Bitcoin’s environmental footprint

Since 2015, Bitcoin’s electricity consumption has been very high compared to conventional digital payment methods. This is because the dollar price of Bitcoin is directly proportional to the amount of electricity that can profitably be used to mine it. As the price rises, miners add more computing power to chase new Bitcoins and transaction fees.

It’s impossible to know exactly how much electricity the Bitcoin network uses. But we can run a quick calculation of the minimum energy Bitcoin could be using, assuming that all miners are running the most efficient hardware with no efficiency losses due to waste heat. To do this, we’ll use a simple methodology laid out in previous coverage on Motherboard. This would give us a constant total mining draw of just over one gigawatt.

That means that, at a minimum, worldwide Bitcoin mining could power the daily needs of 821,940 average American homes.

Put another way, global Bitcoin mining represents a minimum of 77KWh of energy consumed per Bitcoin transaction. Even as an unrealistic lower boundary, this figure is high: As senior economist Teunis Brosens from Dutch bank ING wrote, it’s enough to power his own home in the Netherlands for nearly two weeks.

Digiconomist’s less optimistic estimate for per-transaction energy costs now sits at around 215 KWh of electricity. That’s more than enough to fill two Tesla batteries, run an efficient fridge/freezer for a full year, or boil 1872 litres of water in a kettle.

It’s important to remember that de Vries’ model isn’t exact. It makes assumptions about the economic incentives available to miners at a given price level, and presents a forward-looking prediction for where mining electricity consumption could go. Despite this, it’s quite clear that even at the minimum level of 77 KWh per transaction, we have a problem. At 215 KWh, we have an even bigger problem.

Read More: Ethereum Is Already Using a Small Country’s Worth of Electricity

That problem is carbon emissions. De Vries has come up with some estimates by diving into data made available on a coal-powered Bitcoin mine in Mongolia. He concluded that this single mine is responsible for 8,000 to 13,0000 kg CO2 emissions per Bitcoin it mines, and 24,000 – 40,000 kg of CO2 per hour.

As Twitter user Matthias Bartosik noted in some similar estimates, the average European car emits 0.1181 kg of CO2 per kilometer driven. So for every hour the Mongolian Bitcoin mine operates, it’s responsible for (at least) the CO2 equivalent of over 203,000 car kilometers travelled.

As goes the Bitcoin price, so goes its electricity consumption, and therefore its overall carbon emissions. I asked de Vries whether it was possible for Bitcoin to scale its way out of this problem.

“Blockchain is inefficient tech by design, as we create trust by building a system based on distrust. If you only trust yourself and a set of rules (the software), then you have to validate everything that happens against these rules yourself. That is the life of a blockchain node,” he said via direct message.

This gets to the heart of Bitcoin’s core innovation, and also its core compromise. In order to achieve a functional, trustworthy decentralized payment system, Bitcoin imposes some very costly inefficiencies on participants, for example voracious electricity consumption and low transaction capacity. Proposed improvements, like SegWit2x, do promise to increase the number of transactions Bitcoin can handle by at least double, and decrease network congestion. But since Bitcoin is thousands of times less efficient per transaction than a credit card network, it will need to get thousands of times better.

In the context of climate change, raging wildfires, and record-breaking hurricanes, it’s worth asking ourselves hard questions about Bitcoin’s environmental footprint, and what we want to use it for. Do most transactions actually need to bypass trusted third parties like banks and credit card companies, which can operate much more efficiently than Bitcoin’s decentralized network? Imperfect as these financial institutions are, for most of us, the answer is very likely no.

Get six of our favorite Motherboard stories every day by signing up for our newsletter.