Math Suggests Inequality Can Be Fixed With Wealth Redistribution, Not Tax Cuts

Credit to Author: Daniel Oberhaus| Date: Tue, 17 Oct 2017 16:47:33 +0000

In the last 30 years, income inequality has grown at a rate that hasn’t been seen since just prior to the Great Depression. As Occupy Wall Street sought to remind us, the top 1 percent of the US earns 40 times more than the bottom 90 percent on average.

Although both sides of the political spectrum agree that wealth inequality in the US is real, neither can agree on the best solution to this problem. But what if there was a non-partisan, objective way to assess the causes of inequality and propose a potential solution? A solution based on something like, say, math?

According to a new report published today by the New England Complex Systems Institute, mathematics can indeed be used to find a solution to income inequality. And as it turns out, the math points to targeted programs that redistribute wealth to the poor as the way to close the inequality gap and improve the health of the economy as a whole.

“We need a very measured, but definite shift in direction that will address the economic problems and also address economic inequality problems,” Yaneer Bar-Yam, a physicist and the founding president of the New England Complex Systems Institute, told me. “We went too far with Reaganomics and now we have to go back in order to have healthy economic growth.”

Bar-Yam’s institute uses historical data, computer modeling, and big data to figure out solutions and explanations to the world’s most complex problems (hence the name of the institute). For instance, he was able to predict the Arab Spring before it happened by tying global food prices to riots and violence (and was then able to tie the increase in food prices to two seemingly minor policy decisions that had happened years before). In this case, he has turned his research to the economy.

The new research looks at the way money flows in an economy through two main cycles. In the consumer cycle, workers earn a salary and use this money to buy things. In the production cycle, capitalists invest their wealth in production mechanisms, creating employment and products for the workers and returns on this investment for themselves.

For a country’s economy to grow in a healthy, sustainable fashion, these two cycles must maintain a delicate balance with one another. If there is too much money in the consumer cycle, there aren’t enough goods for the workers to buy and the economy experiences inflation. If there is too much money concentrated in the production cycle, workers don’t have enough money to buy products and there is a recession.

Prior to 1980 there was an imbalance of wealth in the worker cycle (roughly speaking: too much money, not enough products) which led to rampant inflation. After Reagan took office in 1980 and implemented trickle down theory by giving tax cuts to the richest members of society, the imbalance swung the other way. Now, workers didn’t have enough money to buy products, which resulted in a three recessions and the 2008 financial crisis over the past 37 years.

“The interesting conclusion here is that Reaganomics was actually right at the time,” Bar-Yam told me on the phone. “It stopped this imbalance in one direction, but caused us to have imbalance in the other direction. Now we’re in the opposite regime so we need to go in the other direction.”

“It’s a context-dependent thing,” Bar-Yam added.

At the center of these two cycles is the Federal Reserve, which uses interest rates as a sort of pressure valve to control the supply of money in the economy—a policy known as monetarism. When the balance is weighted too much toward the worker cycle, the Fed can raise interest rates to encourage saving and control inflation. When the balance is weighted too much toward the production cycle, like it has been since 1980, the Fed will lower interest rates to encourage consumers to borrow (and spend) money. This operating principle for interest rates is called Taylor’s rule.

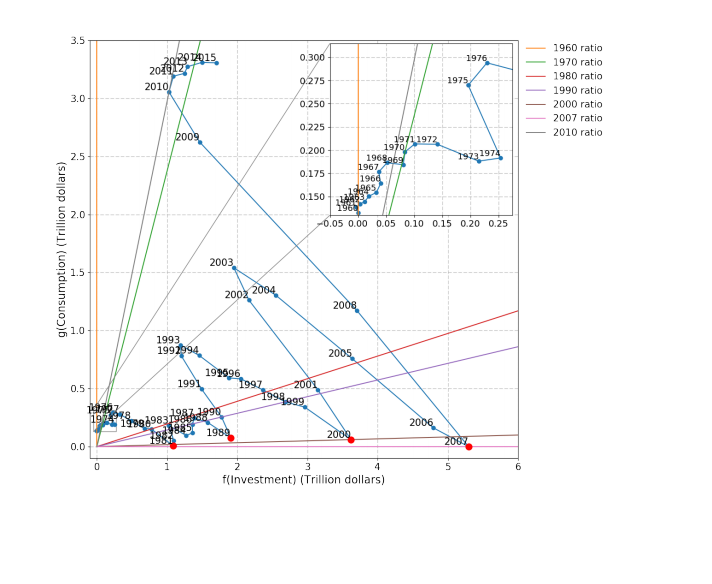

Consider the following graph from the Complex Systems Institute, which plots the ratio between investment and consumption in trillions of dollars. Each red dot toward the bottom of the graph represents a recession since 1980: 1981, 1989, 2000 and the financial crisis in 2007. Each straight line demonstrates what a growing economy would look like if the ratio between investment and consumption were fixed.

Directly following each recession, the ratio of investment to consumption is weighted greatly toward consumption as the Fed lowers interest rates to get consumers borrowing and spending again. This happened in 1990, 2002, and most drastically in 2008, when the federal fund interest rate dropped below 1 percent for the first time in history to help bail the US out of the economic crisis.

The problem is that interest rates have been about as low as they can go for years. This means that the Federal Reserve’s safety valve guarding against a large economic recession or depression has been stretched to its limits. Since Reagan took office in 1980, consumers have racked up 13 trillion of dollars in debt while investors have amassed trillions in capital.

As the graph shows, the tide is beginning to turn toward the investment loop again. This means that consumers are stuck with a major debt burden and spending less while capitalists are not investing in the production cycle. To avoid a major recession, the cycles will have to be rebalanced.

Yar-Bam and his colleagues’ new research shows that a purely monetary solution to the US economy’s current imbalance is insufficient. Yar-Bam likened this to trying to drive a car by focusing only on the gas and brake pedals, and ignoring the steering wheel. In addition to interest rate regulation, Yar-Bam’s research points to a transfer of wealth to the less wealthy sectors of society as the most effective way to rebalance the consumption and production cycles.

This conclusion is based on response theory, a way of looking at complex systems by changing the environmental conditions to see how the system responds. Yar-Bam and his colleagues analyzed historical data to create models that showed how the US economy responds when the distribution of wealth between the production and consumption cycles are altered. Their models demonstrated that the Trump Administration’s current approach to economic growth—cutting government spending while slashing tax rates for the rich—is misguided.

Rather, an effective solution to wealth inequality involves a calculated mixture of government taxes, subsidies, corporate taxes and monetary policies that enable the least wealthy segments of society to act as consumers.

“Consumers have a huge amount of debt and that’s a huge barrier to spending money,” Yar-Bam said. “We can talk about raising the minimum wage, the relief of debt, proposals to eliminate education debt—basically anything that will shift that balance is going to do the right thing right now.”

Ultimately, a systems analysis of the United States points to policies that promote investment in the poorest segments of society, whether through government programs or higher wages. By giving the poorer segments of society the means to buy consumer goods, this then encourages the investment of capital to produce these goods. Without this incentive, the capital would be unlikely to be invested and the economy doesn’t grow.

The schism between the haves and have-nots has been steadily growing for the last few decades and its effects have become impossible to ignore. But a solution to the problem has become mired down in partisan politics. On the one hand, Trump and his fellow conservatives are creating a regulatory regime that gives tax cuts for the richest members of society in accordance with the Reagan-era trickle down theory of economics. On the other, Senator Bernie Sanders and others on the left are calling for a radical redistribution of wealth from the richest portions of society to the poorest.

As Yar-Bam pointed out, there are a number of policy solutions that can realize this wealth distribution, such as raising the minimum wage or lowering the burden of student debt. Although mathematics and systems analyses can point to wealth redistribution as a solution, the actual implementation of this redistribution is mostly a political issue.

Good luck convincing Trump about any of it, though.

Get six of our favorite Motherboard stories every day by signing up for our newsletter .