FinTech builds on blockchain for international mobile payments

Credit to Author: Lucas Mearian| Date: Sun, 15 Oct 2017 21:07:00 -0700

IBM has partnered with a Polynesian payments system provider and an open-source FinTech payment network to implement a new international exchange based on a blockchain electronic ledger.

The new payment network uses IBM’s Blockchain Platform, a cloud service, to enable the electronic exchange of 12 different currencies across Pacific Islands as well as Australia, New Zealand and the United Kingdom.

KlickEx Group, a United Nations-funded, Pacific-region financial services company, and Stellar.org, a nonprofit organization that supports an open-source blockchain network for financial services, are backing the new cross-border payments service.

Payments made and received through KlickEx transfer between bank accounts in the Pacific Islands and Australia, New Zealand and Europe; the service also enables consumers in developing nations to transfer funds directly to mobile wallets.

Blockchain is a public electronic ledger – similar to a relational database – that can be openly shared among disparate users to create an unchangeable record of their transactions, each one time-stamped and linked to the previous one. It can also be used as a private electronic ledger.

Each digital record or transaction in the thread is called a block (hence the name), and it allows either an open or controlled set of users to participate in the electronic ledger. Each block is linked to a specific participant.

Blockchain can only be updated by consensus between participants in the system, and when new data is entered, it can never be erased. The blockchain contains a true and verifiable record of each and every transaction ever made in the system.

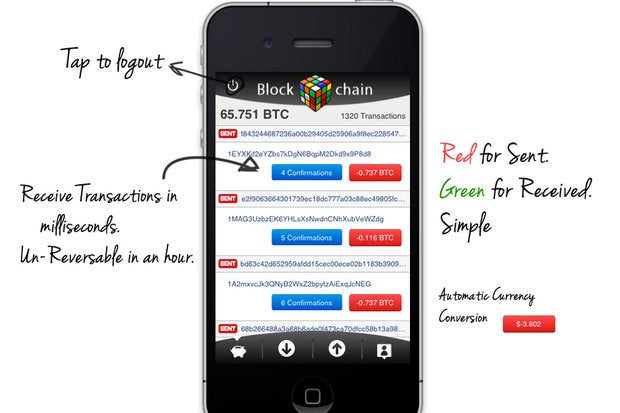

Financial services (see Bitcoin) was the first industry to jump on board the blockchain wagon.

The new IBM-based service is designed to improve efficiency and reduce the cost of making global payments for business and consumers, and for Klickex and Stellar.org, developing nations.

Participants in the Pacific region blockchain exchange include Bank Danamon Indonesia, Bank Madiri, Bank Negra Indonesia, Bank Permata, Bank Rakyat Indonesia, Mizuho Financial Group, National Australia Bank, TD Bank, and Wizdraw of WorldCom Finance. The institutions will collaborate to help expand the distributed ledger’s use in other regions around the world, IBM said.

“In the future, this IBM universal blockchain payment solution is positioned to support central bank-issued digital currencies, securities, bonds and structured financial assets as well,” IBM said in a statement. “IBM is working to explore new ways to make payment networks more efficient, and transparent so that banking can happen in real-time, even in the most remote parts of the world.”

KlickEx CEO Robert Bell said his company’s adoption of the blockchain-based platform will enable a far more scalable and resilient electronic exchange than was previously offered.

KlickEx serves about 80% of households in its Pacific region, and handles 90% to 95% of all electronic payments that are for $200 or less, Bell said.

“We have three times the number of cash in and cash out agents as all the post offices, banks and Western Unions combined across the Pacific,” Bell said. “We had one database system that was running everything.”

While KlickEx’s prior electronic exchange had enabled mobile payments since 2009, the system was limited in scale by the company’s own infrastructure; it served about one million users per day across eight countries, Bell said. When not overtaxed, the KlickEx old exchange system was able to clear payments in between 90 and 200 seconds.

Even so, Bell said, a common processing issue was that payments received would often outpace payments issued, forcing the exchange to use batch processing. That caused a delay that could take days; the new system processes payments in seconds.

“In bringing IBM in to mature the technology, we think we’re pushing something like 8 million…payments per day capacity, which is a long way up from where we started,” Bell said. “So the new real-time system based on blockchain means payment happens immediately, rather than in batch files.”

Users of the electronic distributed ledger can also login and see when a money transfer has been accepted or cleared – for example, by a local grocery store or other merchant.

Along with better scaling, the new blockchain-based system is also distributed so that data can be attained and verified for each country is serves, which helps with regulatory oversight.

The new blockchain-based cross-border payments system provides a future path for immediate clearing and settlement of other digital assets, such as central bank-issued digital currencies, commodities and securities.

The KlickEx/Stellar.org project isn’t the first of IBM’s cross-border blockchain ventures

In June, IBM, AIG and Standard Chartered Bank announced a pilot project to streamline one of the most complex types of policies in the insurance industry – a multinational policy.

The Bank of England is also considering ways it can use blockchain for payments, clearing and settlement.

The computing resources of most blockchains are tremendous, according to Alex Tapscott, CEO and founder of Northwest Passage Ventures, a venture capital firm that invests in blockchain tech firms.

For example, the Bitcoin cryptocurrency blockchain harnesses anywhere between 10 and 100 times as much computing power as all of Google’s serving farms put together.

“In order to move anything of value over any kind of blockchain, the network [of nodes] must first agree that that transaction is valid, which means no single entity can go in and say one way or the other whether or not a transaction happened,” Tapscott said in an online interview. “To hack it you wouldn’t just have to hack one system like in a bank…, you’d have to hack every single computer on that network, which is fighting against you doing that.

“So again, not unhackable, but significantly better than anything we’ve come up with today,” Tapscott said.

Blockchain eliminates huge amounts of recordkeeping, which can get very confusing when there are multiple parties involved in a transaction, according to Saurabh Gupta, vice president of strategy at IT services company Genpact. “Blockchain and distributed ledgers may eventually be the method for integrating the entire commercial world’s record keeping.”