Experian Site Can Give Anyone Your Credit Freeze PIN

Credit to Author: BrianKrebs| Date: Thu, 21 Sep 2017 15:06:57 +0000

An alert reader recently pointed my attention to a free online service offered by big-three credit bureau Experian that allows anyone to request the personal identification number (PIN) needed to unlock a consumer credit file that was previously frozen at Experian.

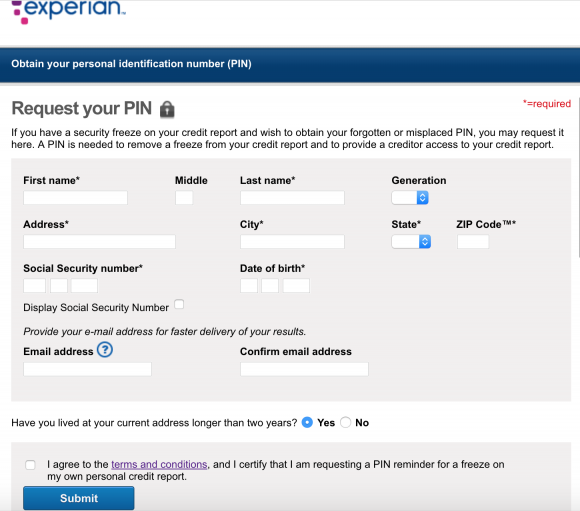

Experian’s page for retrieving someone’s credit freeze PIN requires little more information than has already been leaked by big-three bureau Equifax and a myriad other breaches.

The first hurdle for instantly revealing anyone’s freeze PIN is to provide the person’s name, address, date of birth and Social Security number (all data that has been jeopardized in breaches 100 times over — including in the recent Equifax breach — and that is broadly for sale in the cybercrime underground).

After that, one just needs to input an email address to receive the PIN and swear that the information is true and belongs to the submitter. I’m certain this warning would deter all but the bravest of identity thieves!

The final authorization check is that Experian asks you to answer four so-called “knowledge-based authentication” or KBA questions. As I have noted in countless stories published here previously, the problem with relying on KBA questions to authenticate consumers online is that so much of the information needed to successfully guess the answers to those multiple-choice questions is now indexed or exposed by search engines, social networks and third-party services online — both criminal and commercial.

What’s more, many of the companies that provide and resell these types of KBA challenge/response questions have been hacked in the past by criminals that run their own identity theft services.

“Whenever I’m faced with KBA-type questions I find that database tools like Spokeo, Zillow, etc are my friend because they are more likely to know the answers for me than I am,” said Nicholas Weaver, a senior researcher in networking and security for the International Computer Science Institute (ICSI).

The above quote from Mr. Weaver came in a story from May 2017 which looked at how identity thieves were able to steal financial and personal data for over a year from TALX, an Equifax subsidiary that provides online payroll, HR and tax services. Equifax says crooks were able to reset the 4-digit PIN given to customer employees as a password and then steal W-2 tax data after successfully answering KBA questions about those employees.

In short: Crooks and identity thieves broadly have access to the data needed to reliably answer KBA questions on most consumers. That is why this offering from Experian completely undermines the entire point of placing a freeze.

After discovering this portal at Experian, I tried to get my PIN, but the system failed and told me to submit the request via mail. That’s fine and as far as I’m concerned the way it should be. However, I also asked my followers on Twitter who have freezes in place at Experian to test it themselves. More than a dozen readers responded in just a few minutes, and most of them reported success at retrieving their PINs on the site and via email after answering the KBA questions.

Here’s a sample of the KBA questions the site asked one reader:

1. Please select the city that you have previously resided in.2. According to our records, you previously lived on (XXTH). Please choose the city from the following list where this street is located.

3. Which of the following people live or previously lived with you at the address you provided?

4. Please select the model year of the vehicle you purchased or leased prior to July 2017 .

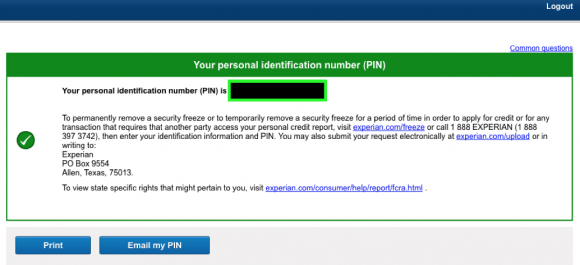

Experian will display the freeze PIN on its site, and offer to send it to an email address of your choice. Image: Rob Jacques.

I understand if people who place freezes on their credit files are prone to misplacing the PIN provided by the bureaus that is needed to unlock or thaw a freeze. This is human nature, and the bureaus should absolutely have a reliable process to recover this PIN. However, the information should be sent via snail mail to the address on the credit record, not via email to any old email address.

This is yet another example of how someone or some entity other than the credit bureaus needs to be in put in charge of rethinking and rebuilding the process by which consumers apply for and manage credit freezes. I addressed some of these issues — as well as other abuses by the credit reporting bureaus — in the second half of a long story published Wednesday evening.

Experian has not yet responded to requests for comment.

While this service is disappointing, I stand by my recommendation that everyone should place a freeze on their credit files. I published a detailed Q&A a few days ago about why this is so important and how you can do it. For those wondering about whether it’s possible and advisable to do this for their kids or dependents, check out The Lowdown on Freezing Your Kid’s Credit.